Fixed Indexed Annuities

An indexed annuity, also known as a fixed-index or equity-indexed annuity, features income payments tied to a stock index, such as the S&P 500. Indexed annuities perform well when the financial markets perform well, but also provide protection from loss when the markets do not perform well. People often refer to indexed annuities as hybrids of fixed and variable annuities.

An indexed annuity is a financial contract between you and an insurance company. It features characteristics of both fixed and variable annuities.

Indexed annuities offer a minimum guaranteed interest rate combined with an interest rate tied to a broad stock market index, such as the S&P 500 or the Dow Jones Industrial Average for example. There are many choices available to us as the index tied to an indexed annuity.

Indexed annuities were created during the stock boom of the mid-1990s when investors were more interested in the potentially higher gains of stocks and less interested in stable, lower returns from investments like bonds. They were specifically designed to compete with certificates of deposit.

An indexed annuity can help you get more growth potential with the comfort of knowing you’re protected from market loss with. You won’t lose any money you put into a fixed index annuity unless you withdraw money or surrender the contract. However, while you won’t lose your principal if the market downturns, in exchange for this safeguard you may give up a portion of the gains from major upswings compared to direct investments or variable annuities.

How Does an Indexed Annuity Work?

After you sign an indexed annuity contract, the insurance company invests your money into the market index of your choice. You can select a single index for your funds or spread your dollars across several indexes. The most common index options include the S&P 500, the Nasdaq 100 and the Russell 2000 but there are many choices available depending on your objectives and preferences.

In exchange for protection against losses, indexed annuities limit how much you earn, even in strong market years. That’s why these contracts are considered less risky than investing directly in the stock market but also offer smaller potential gains.

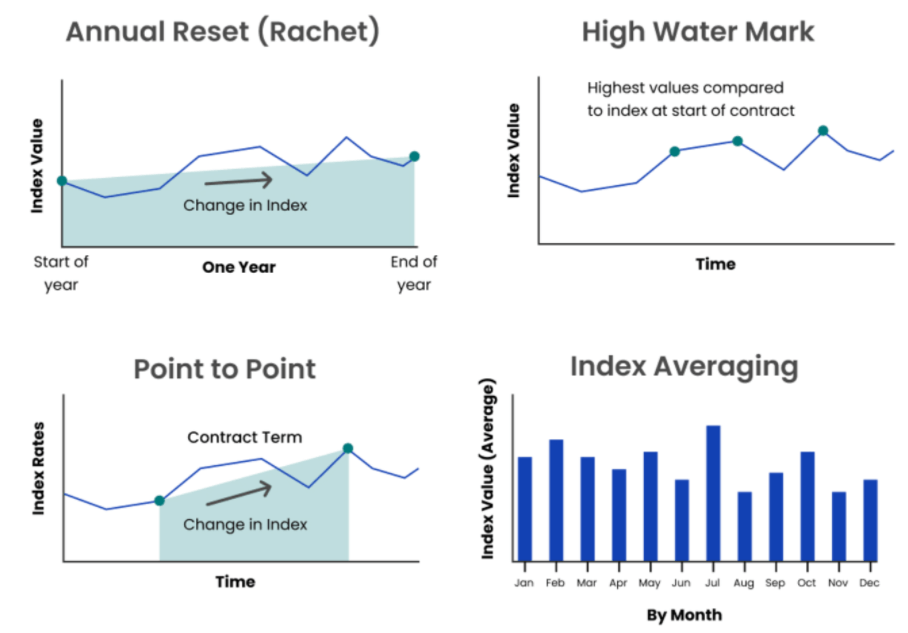

There are several mechanisms insurers use to determine the change in the index over the time you have the annuity:

- Annual Reset or “Rachet”: Compares the change in the index from the start of the year to the end of the year. Declines are ignored.

- High Water Mark: Looks at the index value at various points and takes the highest of the values and compares it to the level at the start of the contract.

- Point to Point: Compares the change in the index rates at two preselected points in time. Typically over a 1 or 2 year segment.

- Index Averaging: Some index annuities average the value of the index daily or monthly, as opposed to the value on a particular date.

Annuities also offer tax advantages. Interest earned within an indexed annuity is tax-deferred. You won’t pay state or federal income tax on the interest until you withdraw it.

Indexing Methods

How Index Annuity Yield Are Determined

How your index rate is calculated will depend on the provisions of your annuity contract. According to the Financial Industry Regulating Authority (FINRA), the computation may typically involve three factors:

- Participation Rate: This is the percentage of the gain in the stock index you will receive on your annuity. For example, if the participation rate is 80 percent and the index gained 10 percent, the annuity would be credited with 80 percent of the 10-percent gain, or 8 percent.

- Spread/Margin/Asset Fee: Some index annuities use this in place of or in addition to a participation rate. This is a percentage that is subtracted from any gain in the index. If the fee is 3 percent and the index gains 10 percent, then the annuity would gain 7 percent.

- Interest Rate Caps: Some index annuities put an upper limit on your return. So if the index gained 10 percent and your cap was 7 percent, then your gain would be 7 percent.

- Guaranteed Minimum Return: Index annuities carry what’s called a guaranteed minimum return. Typically, this means if you buy an index annuity, you are guaranteed to receive at least a certain amount. For example, if the stock market loses 2 percent of its value next year and your guaranteed minimum rate is 3 percent, you’ll earn 3 percent.

If your index performs consistently well, you have the potential to earn a higher return than traditional fixed annuities. On the other hand, if the stock index tanks, your payments will not fall below a preordained level. Guaranteed minimums on indexed annuities typically range from 0 to 3 percent per year.

Should I Get an Indexed Annuity?

An indexed annuity is a good fit for someone nearing retirement and wants to protect their assets from market losses while still having the opportunity to achieve yields higher than fixed annuities with limited market participation. Indexed annuities also offer much lower fees than variable annuities with favorable yearly returns.

Indexed Annuity Pros and Cons

Like any investment, index annuities have their benefits and costs. Since they are essentially a hybrid of fixed and variable annuities, they have a mixture of pros and cons. They have the potential of higher returns without the risk of losing your money. Because these annuities are complicated, they can be difficult to understand.

Pros

- Upside growth potential: In addition to a guaranteed fixed interest rate, your account has the potential to be credited with positive index performance.

- Downside protection: Your account will never be credited less than 0% — even in a down market. So, your hard-earned savings are protected.

- No or low cost: There are no explicit product charges with many fixed indexed annuity.

- As with all annuity types, indexed annuities are tax-deferred products.

- The added increase in yields may serve as a hedge against inflation.

- They often provide better rates than certificates of deposit.

Cons

- The gains of your contract will be capped

- The cap in the increasing value may be reduced in the later years of your contract.

- You face steep surrender charges for early withdrawal.

Comparing Indexed Annuities to Fixed & Variable Annuities

Indexed annuities are just one of the three main annuity types. The other two are fixed annuities and variable annuities.

Fixed annuities are not tied to the performance of the stock market. The interest rate is set in your contract at the time of purchase and does not fluctuate. The funds, therefore, are guaranteed to grow at the same rate for a specified time.

Interest rates on variable annuities change according to the performance of an investment portfolio. However, with variable annuities you can suffer losses with variable annuities. If the investments you choose for your variable annuity decline, then the value of your annuity will also decline.

Variable annuities carry the risk of less growth and the opportunity for more, depending on the underlying investments.

Because the interest rate is tied to market performance, indexed annuities can expose you to a lower yield, as well as a higher yield, than a fixed annuity.

On the other hand, the guaranteed minimum return of an indexed annuity makes it less risky than a variable annuity but with the potential for lower returns.

Frequently Asked Questions

How does an indexed annuity respond to the stock market?

Indexed annuities are not securities and do not earn interest based on specific investments. Rather, indexed annuity rates fluctuate in relation to a specific index, such as the S&P 500. In contrast to variable annuities, indexed annuities are guaranteed not to lose money.

Can you lose money in an indexed annuity?

Indexed annuities guarantee that you won’t lose money. If the index is positive, then you are credited a certain amount of interest based on your participation rate. If the market plumets, you will still receive a fixed rate of return with no loss of your original principal instead.

What are the advantages and disadvantages of an indexed annuity?

The advantages of indexed annuities include the potential to earn more interest than a certificate of deposit or fixed annuities. At the same time protecting the principle against market loss. The disadvantage is capped on the earning potential as compared to other market products and can be more complex than a fixed annuity.

How does an indexed annuity add balance to a retirement portfolio?

A balanced retirement portfolio requires a mix of assets with varying degrees of risk. Because indexed annuities are inherently balanced, they can be included in a portfolio without skewing asset allocation.

Are indexed annuities safe?

Yes, the guaranteed minimum return ensures that an indexed annuity’s value won’t fall below the amount specified in the contract.

What is an annuity rider?

An annuity rider is a contract provision that can be purchased with an indexed annuity to mitigate undesired outcomes and enhance specific benefits.